Contents:

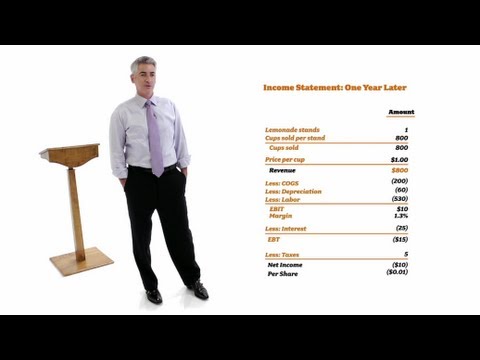

Bulkowski reports that in 68% of double bottom patterns, amount will throwback to the breakout amount. Now this trade might not be favorable to most of the traders as the risk reward ratio may not be favorable. You can make it more favorable and improve the risk reward ratio by thing but that needs you to be very vigilant. To find the Target for the trade, find the difference between the prices at the upper resistance line and the lower support line as shown in the figure.

Candlesticks can be of two types – red or dark, denoting a higher opening price of a security than its closing price, and green or light, implying that the closing price is higher than the opening. Another important characteristic of candlestick patterns is the wick. Also called the shadow, these lines at the upper or lower threshold of a candlestick bar signify the highs and lows reached by the security during a trading session.

The first part belongs to the sellers as price continues to head south. The second part shows an equilibrium between sellers and buyers, and provides the first hint that selling pressure is starting to ebb as price moves in a horizontal range. The third part belongs to the buyers as demand starts to gradually pick up and exceed supply. The reversal is signalled once price breaks above the high that was registered during the start of the pattern. The entire formation takes the shape of a ‘U’, and hence is called a rounding bottom. An inverse H&S is a bullish reversal pattern that appears after a decline in price.

learn about double bottom liquidity 💯 follow @nuevatraders for more ✔️

Update your e-mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Financial data sourced from CMOTS Internet Technologies Pvt. Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary.

Stocks to buy this week: Axis Securities recommends three top picks Mint – Mint

Stocks to buy this week: Axis Securities recommends three top picks Mint.

Posted: Mon, 27 Mar 2023 09:35:25 GMT [source]

These patterns are essential to technical analysis studies and can greatly increase your winning probabilities in the stock market. Double top and double bottom chart patterns are one of the many chart patterns that can be used by investors and traders to take suitable trading positions to curate a profitable portfolio. The analysis of these patterns and the way to trade using the same is mentioned below. This type of pattern follows an uptrend of the curve on the chart.

You can take the advantage of price fall when the swing lows are broken. Please refer to the illustrative image provided above for better understanding of the descending triangle pattern. Murphy cautions the terms “double tops and bottoms” are greatly overused in the markets. Most of the patterns referred to as double bottoms are, in fact, something else. Feel the real power of trendlines with help of auto trendliens & Trendline scanner with option of finding stocks which has found support / resistance of trendlines or break. Simple pattern like double bottom / top and complex patterns like Wolfe waves or head and shoulder pattern scan available.

Market Dashboard

The neckline could be upward sloping, horizontal, or downward sloping. Based on experience, an upward sloping or horizontal neckline is preferred over a downward sloping neckline. The above chart shows an ascending triangle pattern acting as a bullish continuation pattern. Notice the upticks in volume as the price heads higher inside the triangle. However, also notice that there was hardly any increase in volume at the time of the breakout on the first occasion.

- RSI below 30 is considered oversold and above 70 is considered overbought, Trendlyne data showed.

- A double bottom is formed following a single rounding bottom pattern which can also be the first sign of a potential reversal.

- Do not share of trading credentials – login id & passwords including OTP’s.

- Based on this, traders try to predict how the price will move in the future.

- Thus, before landing on results and confirmation of the pattern, it is highly recommended to relook patiently.

This stock has broken out from the downdownward-slopingndline on the daily chart with higher volumes, adjoining the highs of the week ending January 6, 2023, and February 17, 2023. This stock has broken out on the weekly chart from the downward-sloping trendline, adjoining the weekly highs of September 17, 2021, December 2, 2022, and December 23, 2022. The stock price has broken out from the downward-sloping trendline, adjoining the highs of December 5, 2022, and January 3, 2023. The consumer products business is demerged into Crompton Consumer Products where the company will hold 25% plus one share.

Recently, this counter has formed a bullish shark structure on a daily scale along with bullish divergence seen on RSI and MACD histogram which is looking lucrative. Also, the stock has been moving in a rising channel indicating the bullishness in price action. It has taken support at the lower band of Bollinger bands, signalling that the short-term support has been established, and a Bollinger band upward band will serve as a target zone. “With indicators improving and showing strength with immense upside potential, we recommend a buy in this stock,” said the analyst.

Technical Analysis: How to trade Double bottom pattern

The opposite of the head and shoulder pattern is the inverse head and shoulder pattern. The inverse head and shoulder pattern implies that the share price is ready to break out and move higher once the neckline is taken out. What you do is that at Top 2, you assume that it is Double Top pattern information. Wait for a red candle to appear at Top 2 on the daily chart. After the red candle is formed, on next trading day, you enter the short trade at a price near the middle of the previous red candle. Double Top Double Bottom chart patterns are the reversal chart patterns.

The basic requirement for the identification of a double bottom pattern is the presence of the prevailing bearish trend that is set to be reversed. Short-term traders can look to buy the stock now or on dips for a possible target towards Rs 4,300 level in the next 3-4 weeks, suggest experts. Double top and bottom patterns are formed from consecutive rounding tops and bottoms. These patterns are often used in conjunction with other indicators in technical charting. On the weekly timeframe prices were in a strong uptrend from May 2020, Post September 2021 prices witnessed a pause in the trend.

Preferably, the double bottom stocksdown from the triangle must be accompanied by an increase in volume. However, pickup in volume at the time of breakdown in case of this pattern is not as important as pickup in volume at the time of breakout in case of an ascending triangle pattern. Meanwhile, in some cases, the pattern will break on the upside. If this happens, and if volume has picked up after the breakout, then a move higher can be expected. A rounding top is a bearish reversal pattern that appears at the end of an uptrend.

Just keep in mind that rectangles are more likely to continue the prevailing trend rather than reverse it. A triple bottom is a bullish reversal pattern that appears after a decline in price. While the double bottom pattern has two bottoms and one intervening high, a triple bottom pattern has three bottoms and two intervening highs.

However, sometimes, an ascending triangle can also appear as a reversal pattern, especially when it develops after a prolonged rally or a prolonged decline in price. An ascending triangle represents a pause to the ongoing trend, during which the price broadly consolidates within a set range. The pattern comprises of at least two bottoms and at least two highs, with the second bottom being above the first bottom and the second top essentially at the same level as the first top. The peaks can be connected using a horizontal trendline, while the troughs can be connected using an upward sloping trendline. Although this is a bullish pattern, do not pre-empt that the break will happen on the upside. Wait until the price breaks out of the horizontal resistance line before deciding to initiate a trade.

Flag Pattern

There are many strategies and patterns that help investors and traders understand the movement of the stocks and the market trends. One of such patterns commonly used in trading is the double top and double bottom pattern. A rounding bottom is a bullish reversal pattern that appears at the end of a downtrend. This pattern marks an end to the prevailing downtrend as it represents a gradual shift from supply to demand.

While a contracting https://1investing.in/ pattern has two trendlines that are converging, an expanding broadening pattern has two trendlines that are diverging. This pattern is characterized by lows getting lower and highs getting higher. When the lows are connected, we have a downward sloping trendline.

The first thing that you need to keep in mind is that a Double Top or Double Bottom pattern is a price reversal pattern. However, you must remember that while these patterns can indicate trend reversals, they are not certain. Studying the reversal trends helps enhance your growth in trading. Sometimes you might feel lost among the charts and patterns, but you should know that you won’t become Warren Buffet in a day; even the best ones sometimes stumble and fall. Just like Abhishek Bachchan in The Big Bull, you must build your strategy in the financial market. And to build a proper strategy, you must clear your doubts about various aspects of the stock market, especially the various charts and patterns.

It is one of the most reliable and easy to spot patterns of all. A H&S top is a bearish reversal pattern that appears after a rally in price. The first peak is called the left shoulder, the second peak is called the head, and the third peak is called the right shoulder. Once this peak is made, price usually retraces part of the advance before bottoming out.