Contents

A wholly-owned business is totally controlled by the Indian law, i.e. the Companies Act 2013. We are the exclusive member in India of the Association of International Tax Consultants, an association of independent professional firms represented throughout Europe, US, Canada, South Africa, Australia and Asia. Easily pay online with EMI payments, credit or debit card, net banking, PayPal and more. A company may decide to have subsidiaries for a variety of significant reasons. Corporate entities can reduce their liabilities while expanding their business through subsidiaries.

The person whose name is registered under the Register of Members has to submit the declaration in Form MGT 5 with a cover letter within 30 days to the company in which he is registered from the acquisition date. The entry route through which investment by a person resident outside India requires prior Government approval. The foreign investment received under this route shall be under the conditions stipulated by the Government in its approval. Foreign Investment in the following sectors/activities is, subject to applicable laws/ regulations, security, and other conditionalities.

What is the Use of Master Service Agreement?

Vakilsearch is India’s largest provider of legal, secretarial, accounting, and compliance services. We have successfully worked with over 5 lakh customers, and have now registered over 10% of all the companies registered in India. In case a transfer has not been registered in the books of a company, then the transferor shall be entitled to receive dividend if he is a registered holder as on the record date. Wholly owned subsidiaries also offer an opportunity for firms to diversify and manage risk. For example, a pc company might resolve to get into the printer enterprise, the television business, and the pill enterprise and both buy or form a completely owned subsidiary for every new enterprise. A company can be registered as private limited or public limited following all the rules and regulations framed by the Companies Act, 2013.

Yes, referring to the provision stated above the beneficial holder can receive dividend from the company by virtue of the order given by the registered holder. A wholly owned subsidiary is a company whose entire stock is held by another company, called the parent company. The subsidiary usually operates independently of its parent company – with its own senior management structure, products and clients – rather than as an integrated division or unit of the parent. The monetary benefits of an entirely owned subsidiary embrace easier reporting and extra monetary resources.

It is recommended that at least one Director be an Indian Citizen and Indian Resident, while the other Board members can be of any nationality or residency. In the instant case there is change in the beneficial interest of the shares held by Mr. A, therefore, declaration as prescribed u/s 89 shall be given by Mr. X and M/s BBC Ltd, a and thereafter by ABC Ltd. Under this section Registered owner/ Beneficial owner/ Company is required to intimate to ROC after entering his name in register of members or change therein the declaration so filed. Now, the company on getting both the forms MGT 4 and MGT 5, the company in turn will send the same to the board for approval. The Registrar of Companies should inmate e-form MGT 6 within 30 days prior to the receipt date of form MGT 4 and MGT 5.

The subsidiary works with the parent company’s approval and may or may not have direct input to the activities and management of the subsidiary. As all documents has filed electronically and you would not need to be physically present at all. Therefore, You would need to send us scanned copies of all the required documents & forms. However, the legal guidelines require the father or mother firm to have a controlling stake over the subsidiary. For this, the father or mother firm has to own no less than eighty % shares of stock of the subsidiary and will need to have the ability in the identical.

Subsidiary corporations should not be confused with mergers where the parent firm purchases a company and dissolves its identity and organizational construction. Damage from the failure of one subsidiary will not essentially be fatal to the parent company. However, establishing a wholly owned subsidiary could outcome within the father or mother firm paying an excessive amount of for assets, especially if other firms are bidding on the identical business. In addition, establishing relationships with vendors and local purchasers typically takes time, which may hinder company operations; cultural variations could turn into a problem when hiring staff for an overseas subsidiary. Whether the parent company is the only or majority stockholder of the subsidiary company, it’s going to have nearly complete management of the subsidiary company’s operations.

Wholly Owned Subsidiary of Foreign Company under Companies Act, 2013

Wholly owned subsidiary companies have all of their stocks controlled by the main company. Affiliate companies have only a minor portion of their stocks controlled by the main company. Indian bank will update the company about the receipt of money and will share details required to transfer money in companies Capital accounts. The Ministry of Corporate Affair has notified the Companies Act, 2015 to remove the minimum capital levels required for Incorporating a company. Therefore, there is no minimum capital requirement needed for Incorporating any type of company.

Advantages of using wholly owned subsidiaries include vertical integration of supply chains, diversification, risk management, and favorable tax treatment abroad. A company becomes a father or mother firm when it owns one other separate, legal entity commonly generally known as a company or enterprise. A wholly owned subsidiary is a company whose common stock is completely (100%) owned by a parent company.

Coffee giant Starbucks Japan is Starbucks Corp wholly-owned subsidiary. It is considered a domestic company under tax law and is entitled, as applicable to all other Indian companies, to all deductions, allowances from the deduction. CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

Main characteristic of 100% Wholly Owned subsidiary:

Your workforce are a credit to you, the girls at reception are so helpful and Chris has been brilliant. A subsidiary business can help you to expand your current business, while reducing the risk. Companies with several subsidiaries are able toreduce dividendsfrom one subsidiary with losses from another, thereby reducing their tax burden. Where 100% is permitted, no prior approval is needed or appropriate for RBI . Save taxes with ClearTax by investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP.

A company can avoid competition while entering a new market by combining with its subsidiary. When local and foreign entrepreneurs both jointly form a new enterprise.

- Since the mother or father company owns all the subsidiary’s inventory, it has the right to appoint the subsidiary’s board of directors, which controls the subsidiary.

- ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

- Under the erstwhile Companies Act, 1956, section 153 specifically stated that trust cannot become a member of a company.

- A father or mother company can change its ownership status by selling a few of its voting shares, purchasing extra shares or promoting all of its shares.

- The subsidiary has its own bank accounts, working capital and ownership of assets, apart from the stock issued to the mother or father company.

A wholly-owned subsidiary may be in a different country than the parent company. Owning a wholly-owned subsidiary might help the parent company maintain its operations in wide https://1investing.in/ geographic areas and markets or a different separate industry. A company whose 100% of the common stock is owned by the parent company is called a wholly-owned subsidiary.

Wholly Owned subsidiary in India by foreign company

The monetary disadvantage is that an execution error or malfeasance at a subsidiary can seriously have an effect on the monetary performance of the parent company. A father or mother company can change its ownership status by selling a few of its voting shares, purchasing extra shares or promoting all of its shares. wholly owned subsidiary example The parent company always takes on all the risks of owning a subsidiary. It may increase if the local legislation is considerably different then the laws in the parent company’s country. If a parent firm wishes to acquire an affiliate business then it can either purchase an existing company or establish the company.

A company is liable to be a wholly-owned subsidiary through an acquisition by a parent company, apart from this a regular subsidiary company is only 51-99% owned by the parent company. The parent company on acquiring all the shares of a wholly-owned subsidiary, there are no minority shareholders. The subsidiary with the permission of the parent company operates in their own division, this act makes them an unconsolidated subsidiary.

Nevertheless, establishing a wholly-owned subsidiary may also cause the parent company to pay too much for the assets, mainly if other companies wish to bid on the same business. It also takes a lot of time to build ties with all the sellers and local buyers, delaying companies’ activity. Cultural differences can become a huge problem when recruiting workers from an outside affiliate. A wholly-owned subsidiary is basically for instance, maybe in a country different than that of the parent company. The subsidiary is most likely to have its own executive structure, products, and customers.

The requirement to give declaration arises only in case of a change in beneficial ownership. Therefore, in the above case since the beneficial owner remains the same, no declaration is required to be given. A “wholly owned subsidiary” is when the parent company owns all the voting stocks of another company. A company may establish a subsidiary by forming a new corporation and retaining all or part of its stock.

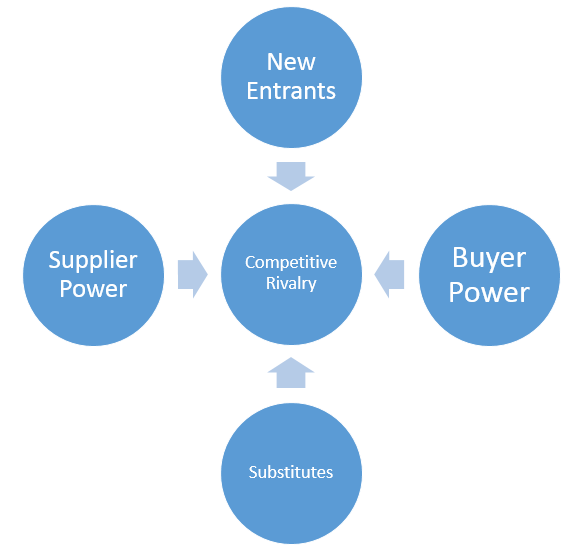

Given below is the diagram illustrating a situation of a holding company appointing a nominee to meet the statutory minimum limit of two members in a wholly-owned private subsidiary company. This article deals with the concept of beneficial owner, registered owner of shares & wholly Owned Subsidiary. It also can use the subsidiary’s earnings to grow the enterprise or invest in different assets and companies to generate the next rate of return. Additionally, the two corporations can combine their monetary and different info know-how systems to streamline enterprise processes and scale back costs.

We generate ideas, spark actions and quantify time-bound results by providing tailored, practical and affordable solutions for the growth of your company. In the new web-based form SPICe+, the applicant can mention only one proposed name for the proposed company along with all other details and required documents. The entry route through which investment by a person resident outside India does not require the prior Reserve Bank approval or Government approval. The team Ebizfiling believes in providing well researched, truest and verified information to its clients and readers. The team works continuously towards enhancing Ebizfiling.com to make it a no. one platform not only for providing the best services but also for providing information to everyone through the website.

Subsidiary corporations are separate legal entities created by the father or mother company or another get together. Subsidiaries aren’t divisions of the father or mother company – divisions are incorporated into the mother or father firm and not legally separate. A subsidiary firm is usually known as a daughter or youngster firm to the father or mother or holding firm.