The leading online publication for the accounting profession

Financial accounting

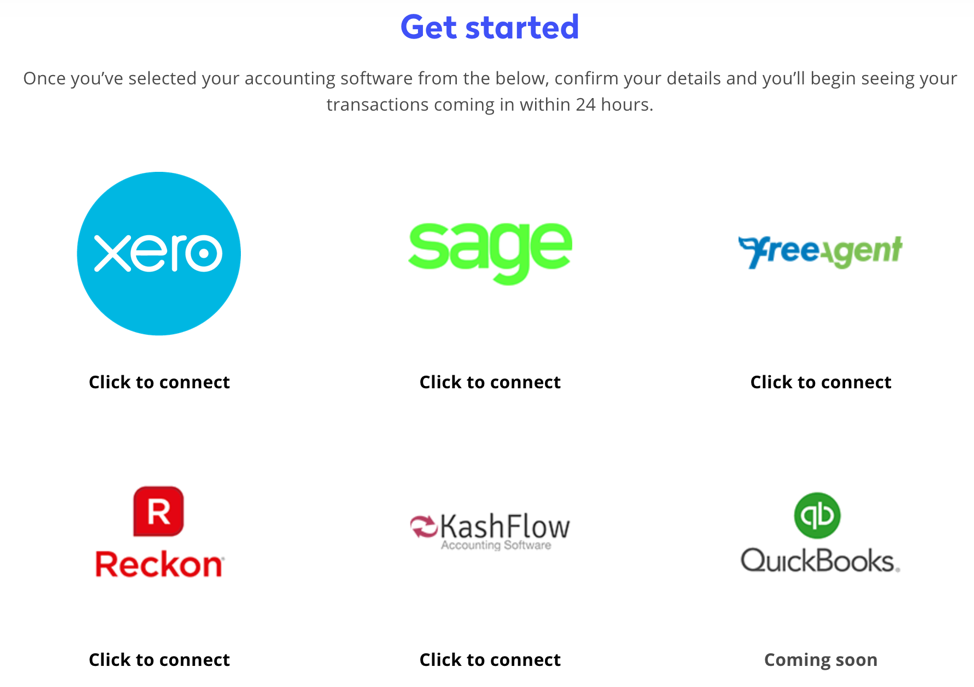

You’ll cover topics including tax, student loans, credit, debt, pensions, insurance, savings and investments. This module will provide you with introductory online accounting knowledge covering basic double entry book-keeping, analysis and preparing a simple set of financial statements. Save time on small business bookkeeping by automating everyday tasks, with Xero’s accounting software.

You may decide to opt for a placement year, where you develop your professional skills and build a network of business contacts. A placement year can give you a career advantage by showing future employers that you are a dedicated and experienced professional. Accredited by the Institute of Chartered Accountants England and Wales (ICAEW) for the purpose of exemption from some professional examinations. Accredited by the Association of Chartered Certified Accountants (ACCA) for the purpose of exemptions from some professional examinations. In your final year of your accounting degree, you have the opportunity to put your knowledge into practice by completing an in-depth, independent research project or dissertation.

The module continues by considering performance management systems which have been developed to control the implementation of strategic plans. Preparing business plans, Raising finance, Options over format (private, public, partnership), Taxation, Essential Accounting records, relationship with marketing, production, R&D etc. The module will cover the reporting, strategy and financial management of companies and link theory to practice through practical exercises and case studies.

In addition to this, the module will consider business performance measurement and behavioural and environmental issues in management accounting. You will also learn how to choose and apply management accounting tools and techniques in various business contexts in order to support planning, control and decision-making within organisations.

This module covers the regulatory aspects of financial reporting. It will enable you to understand and evaluate financial statements according to international accounting standards. You will be set up to move into working in management or financial accounting jobs in the corporate, public or voluntary sectors.

Your lectures and seminars will be delivered by specialist tutors and guests, focusing on themes such as international accounting and finance, professional practice, public service finance, strategic leadership, entrepreneurship, sustainability and ethical issues, and career management skills, including effective job search strategies, realising your full potential via ‘personal branding’ and management of your online presence and requirements and qualifications for the various accounting and finance professional bodies. as Financial and management accounting and other closely related fields in the professional services sector.

Our finance academics have been cited in the Bank of England, the European Central Bank and the Federal Reserve and are known for their work on financial econometrics, behavioural finance and banking, amongst other research interests. 79% of Essex Business School undergraduates are in professional employment or postgraduate study within six months of graduating (DLHE 2017). Many of our what are retained earnings, finance and banking courses are professionally accredited and develop your ability to solve complex business problems and make responsible, ethical decisions that ensure organisations thrive, not just survive. Management accounting serves the purpose of identifying, measuring and communicating economic information to permit management and workforce make informed judgements and decisions. Investigate the technical issues in cost management and performance measurement systems, and wider issues concerning the role of management accounting in shaping management structures and decisions in manufacturing and service contexts.

- Many of our Accounting, Finance and Banking courses are professionally accredited and give you exemptions from some professional exams, including ACCA and CIMA.

- It gives your guidance on how to use feedback effectively to improve and develop your academic skills and improve your performance.

- You will also have access to careers advice, work placements, paid and voluntary work opportunities and career mentoring.

- Studying at university may be very different to your previous experiences.

- You gain the skills, confidence and advanced knowledge to thrive in the demanding, and continually changing, fields of accounting, finance and banking.

- Accounting and Finance is an integral function within the global business environment.

If you encounter any problems which affect your studies, your personal tutor should always be your first point of contact; she/he will be able to put you in touch with the wide range of expert student support services provided by the University and the Students’ Union as appropriate. You are required to meet with your personal tutor three points during each academic year but you are also encouraged to get in touch with them at any other point if you need help or advice. Modules in corporate reporting and strategy, bookkeeping management and control will preface opportunities to tailor your degree to your career ambitions. Prepare for your accounting career with exemptions from chartered accounting professional examinations.

Graduates of a Masters programme in accounting may obtain employment in a variety of careers in accounting or management related areas. Whether you want to work for a multinational, SME or public sector organisation, our courses equip you with the knowledge, skills and attributes necessary to succeed in business management.

We now offer five Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Working Capital and Liquidity, and Payroll Accounting. Click here to learn more. By getting into the habit of entering all of the day’s business transactions into his computer, Joe will be rewarded with fast and easy access to the specific information he will need to make sound business decisions. Marilyn tells Joe that accounting’s “transaction approach” is useful, reliable, and informative.

Study on a degree accredited by the Chartered Institute of Management Accountants (CIMA), the Institute of Chartered Accountants in England and Wales (ICAEW) and the Association of Chartered Certified Accountants (ACCA). A programme of industry-specific workshops, organised in partnership with professional online bookkeeping firms and accrediting bodies, complements your academic study with exposure to real-world accounting and finance scenarios. Our BSc Accounting programme is accredited by the Accounting Professional Bodies and is designed to equip you with practical skills and professional confidence for a successful accounting career or in preparation for postgraduate study and research.

Therefore, most companies will have annual audits for one reason or another. The financial statements that summarize a large company’s operations, financial position, and cash flows over a particular period are concise and consolidated reports based on thousands of individual financial transactions. As a result, all retained earnings designations are the culmination of years of study and rigorous examinations combined with a minimum number of years of practical accounting experience. Accounting is one of the key functions for almost any business. It may be handled by a bookkeeper or an accountant at a small firm, or by sizable finance departments with dozens of employees at larger companies.

Second year modules

Financial accounting refers to the processes used to generate interim and annual financial statements. The results of all financial transactions that occur during an accounting period are summarized into the balance sheet, income statement, and cash flow statement. The financial statements of most companies are audited annually by an external CPA firm. For some, such as publicly traded companies, audits are a legal requirement. However, lenders also typically require the results of an external audit annually as part of their debt covenants.

With the aid of appropriate professional statistical software you will be encouraged to apply statistical methods of analysis to data. The module is designed to allow you the opportunity to analyse and interpret “real data” from various areas of the business world.

Students taking this module will hone their critical skills, learn to question the status quo and recognise the political and cultural context in which accounting operates. Students will also look at a range of issues and examine what impact, if any, these could have on accounting and finance. IFRS’s will then be studied to examine both how they have been influenced by the IASB’s conceptual framework and how they are applied in practice. The choice of standards to be studied will be influenced by current developments in accounting. The preparation of financial statements for groups of companies and related IFRS’s will also be studied.