How to Predict Price Movements in the Forex Market

However, an upwards breakout may signal continued bullish conditions, and the divergent resistance and support of the market provide increasing volatility over time. Ascending broadening wedges are recognisable as being “megaphone-shaped”. Resistance and support lines broaden gently, with a slight upturn, more common in a bull market – though considered a weak bearish signifier – this trend most often resolves in a downward breakout.

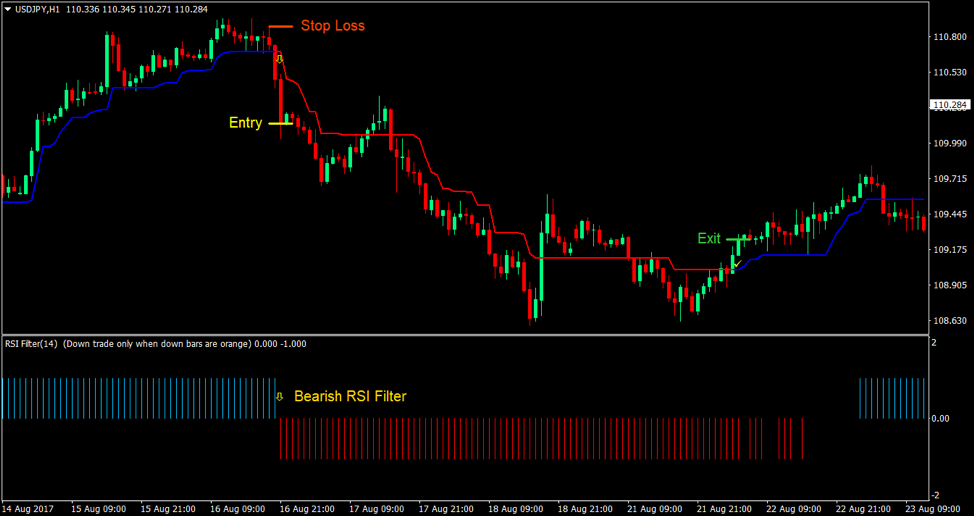

The chart below depicts the point when traders should be on the lookout for a trend reversal as the market breaks lower than the previous low. Put a 200 and forexhero.info 50 day ema on your chart and check out the long-term slope of these ema’s. This is a good quick way to identify the overall dominant trend of a market.

We provide real-time forex news and analysis at the highest level while making it accessible for less-experienced traders. To scale out means to partially close your position as the trend goes in your favor. Trends are not infinite, so gradual reduction in your position size will allow you to stay in the market for longer and not to risk the entire position size. Trailing Stops and moving SL to breakeven also constitute elements of flexible approach to Forex trends. The example of scaling in is represented at the picture below.

It’s not because I’m not looking at FX charts, I am. For years, I’ve maintained a strict daily discipline, skimming through a series of key charts at speed, always in the same format and the same order. Like a captain on a ship or air traffic control, I’m looking to see if everything is in the correct place and what stands out as a glaring aberration or unusual trend. For instance, if you have a series of Higher Highs and Higher Lows as in an uptrend, when you see price break down past the previous swing low, it’s a strong indication that the uptrend might be ending. Conversely, in a downtrend we see Lower Highs and Lower Lows, and when price breaks above the previous lower high, it’s a strong indication that the downtrend might be ending.

Why is the trend your friend in forex trading?

Notice how each rally spent less time away from support as the trend became extended. The EURUSD daily chart below is a perfect real-world example of a currency pair that began testing support more rapidly over the course of 256 days.

To be clear, trend analysis is only one part of the overall trading strategy I employ to enter and exit trades. It is never a good idea to enter a trade based on one factor alone, which is why I look for as much evidence as possible to confirm a trade. In my own trading plan, I employ a concept known as T L S confluence, an analysis technique which brings together; trend analysis, level analysis, and signal analysis.

The idea is that history may repeat itself in predictable patterns. In turn, those patterns, produced by movements in price, are called Forex signals.

Let’s start things off by just visualizing where the highs and lows on a chart have formed over a period. In short, the relationship among highs and lows as they form over time. But before you leave thinking you know about the concept of higher highs, higher lows, etc., there are some concepts later in the lesson that may not be familiar to you. In fact, I would bet that 90% of Forex traders don’t know to look for what I’m about to show you. Notice that the MACD indicator is now located in its top area, indicating that we might see the end of this bullish trend soon.

Identifying forex trends will prevent you from trading against the market trend. Identifying forex trends is not hard if you know how to do it. Forex market trends don’t come often but if they do, you can use it to trade the trend.

- Ascending broadening wedges are recognisable as being “megaphone-shaped”.

- I am thinking of throwing in the towel.

- When you can understand what type of trend you are in, then you can correctly apply the strategy, price action setup, or proper tool trade that trend.

- In forex trading, a major indicator is the one that comes with a long timeframe, while intermediate would last for about three to two months and short terms stay less than a month.

- Don’t hurry with opening a position.

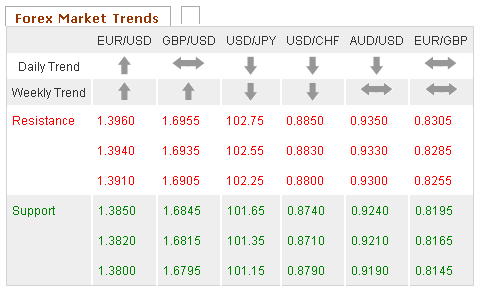

The GBPUSD daily chart below is a perfect example of how something as simple as watching how the highs and lows of a market interact with each other can signal a change in trend. The Forex Market Map is updated every 10 minutes throughout the trading day. Forex prices are delayed 10 minutes, per exchange rules, and trade times are listed in CST. The Forex Long-Term Trends page is re-ranked every 10 minutes. During active trading, you will see new price information on the page, as indicated by a “flash” on the fields with new data.

The chart below depicts a strong uptrend confirmed by higher highs and higher lows. Drawing a trend line that connects multiple lows in an uptrend and multiple highs in a downtrend is often an easy way to identify the trend from a visual perspective. It is important to note that there are no specific rules for identifying high and lows to use for trend analysis. The idea is to pick the most obvious examples of an uptrend or a downtrend to trade. If the trend is down, confirm the downtrend by looking for a series of lower highs and lower lows on the chart.

Note that these parallel lines do not have equal power. During an uptrend support line https://forexhero.info is the main one, while during the downtrend resistance line has bigger significance.

How to Identify Trends in Forex Trading like a Pro

All technical tools such as chart patterns, trendlines or support/resistance zones serve the purpose of early identifying trends and have returned great results in the forex market so far. Trends can also be identified by combining techniques. The combination of consecutive higher moving average levels with a moving average crossover can confirm that an uptrend is in place. An investor can also combine price action and moving averages to help define a trend. For example, consecutive higher highs along with a climbing moving average can confirm an uptrend.

The Stages of a Forex Trend

We will discuss a few trading techniques for spotting potential trends on the chart. Bearish trends have opposite functions to bullish trends. The trend is bearish when the price action creates lower tops and lower bottoms on the Forex chart. In this case the bearish trend line should be drawn through the swing tops on the chart and the resulting trendline acts as a resistance for the price.

In trading, we all know there are a lot of variables. One huge forex variable is the trend. Almost every trader wants to recognize the trend, whether they are going to trade with it or against it. But it begs the question, what is the trend? We determine this through trend analysis.